BVN is important for a variety of financial transactions in Nigeria. If you need to check your BVN on the GTBANK app, follow these steps:

1. Open the GTBANK app on your phone.

2. Log in to your account.

3. Tap on the "Menu" icon in the top-left corner of the screen.

4. Scroll down and tap on "Settings".

5. Under the "Personal Information" section, tap on "BVN".

6. Your BVN will be displayed on the screen.

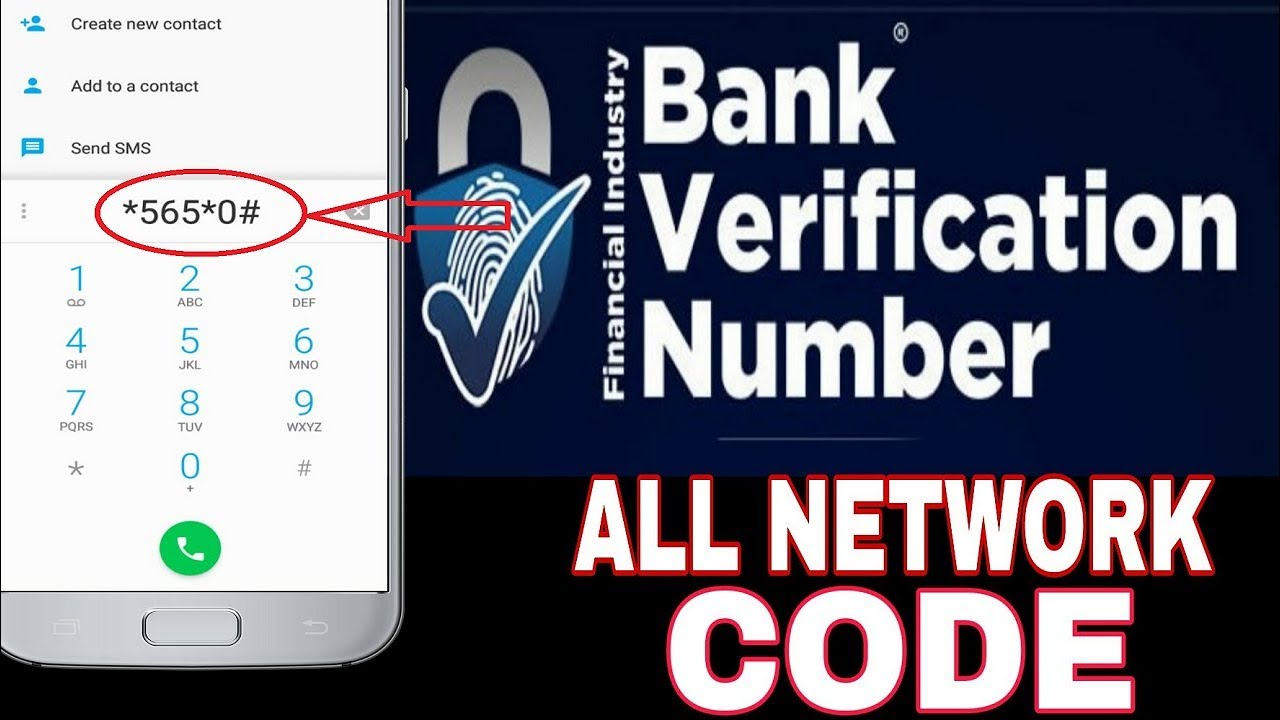

You can also check your BVN by dialing 5650# on your phone.

How to Check BVN on GTBANK App

BVN is a unique 11-digit number that is used to verify your identity when you carry out financial transactions in Nigeria. It is important to know how to check your BVN, especially if you need to update your records or if you have forgotten your number.

- Simple and Convenient: Checking your BVN on the GTBANK app is a quick and easy process that can be done in just a few steps.

- Secure and Reliable: The GTBANK app is a secure platform that uses multiple layers of security to protect your personal and financial information.

- Real-time Access: You can check your BVN on the GTBANK app anytime, anywhere, as long as you have an internet connection.

- No Hidden Charges: There are no hidden charges or fees associated with checking your BVN on the GTBANK app.

- 24/7 Availability: The GTBANK app is available 24 hours a day, 7 days a week, so you can check your BVN whenever it is convenient for you.

In addition to the key aspects listed above, here are some other benefits of checking your BVN on the GTBANK app:

- You can use the GTBANK app to update your BVN if it has changed.

- You can use the GTBANK app to link your BVN to your other bank accounts.

- You can use the GTBANK app to check your BVN transaction history.

Simple and Convenient

One of the key benefits of checking your BVN on the GTBANK app is that it is simple and convenient. The app is designed to be user-friendly, with a straightforward interface that makes it easy to navigate. Checking your BVN can be done in just a few steps, and the entire process takes only a few minutes. This is in contrast to other methods of checking your BVN, such as going to a bank branch or calling customer service, which can be more time-consuming and inconvenient.

The simplicity and convenience of checking your BVN on the GTBANK app make it an ideal option for anyone who needs to access their BVN quickly and easily. This is especially important for people who need to check their BVN frequently, such as for business purposes or for online transactions.

In addition to being simple and convenient, checking your BVN on the GTBANK app is also secure. The app uses multiple layers of security to protect your personal and financial information, so you can be confident that your data is safe.

Overall, checking your BVN on the GTBANK app is a simple, convenient, and secure way to access your BVN. If you need to check your BVN, we recommend using the GTBANK app.

Secure and Reliable

When it comes to checking your BVN on the GTBANK app, security is of paramount importance. The GTBANK app employs robust security measures to safeguard your sensitive data, providing peace of mind during the process.

The app utilizes multiple layers of security, including encryption, authentication protocols, and fraud detection systems, to protect your information from unauthorized access and cyber threats. This layered approach ensures that your personal and financial data remains confidential and secure throughout the process of checking your BVN.

By leveraging these advanced security measures, the GTBANK app creates a secure environment for you to access your BVN conveniently and with confidence. The app's commitment to security ensures that your financial transactions and personal information are protected, giving you the assurance you need when managing your finances.

Real-time Access

The real-time access provided by the GTBANK app is an integral component of "how to check BVN on GTBANK app." It enables users to conveniently retrieve their BVN whenever they need it, without the constraints of time or location. This feature is particularly valuable in situations where immediate access to BVN is crucial, such as during financial transactions or when verifying identity for various purposes.

The ability to check BVN in real-time empowers users with greater control over their financial activities. They can promptly access their BVN for online banking, fund transfers, or other transactions that require BVN verification. Moreover, thenature of this feature eliminates the need for visiting bank branches or relying on alternative methods that may be subject to delays or limited availability.

In summary, the real-time access offered by the GTBANK app significantly enhances the overall experience of checking BVN. It provides users with the flexibility and convenience to retrieve their BVN whenever and wherever they need it, contributing to the efficiency and effectiveness of their financial management.

No Hidden Charges

The absence of hidden charges is a crucial aspect of "how to check BVN on GTBANK app" as it directly impacts the user's experience and financial well-being.

- Transparency and Predictability:

The lack of hidden charges provides transparency and predictability in the process of checking BVN. Users can trust that the information they receive is accurate and that they will not be subject to unexpected fees. This transparency builds trust and confidence in the GTBANK app as a reliable platform for managing financial information.

- Cost-Effectiveness:

By eliminating hidden charges, the GTBANK app promotes cost-effectiveness. Users can check their BVN as often as needed without worrying about accumulating additional expenses. This cost-effectiveness makes the app accessible to a wider range of users, particularly those who are budget-conscious or frequently require BVN verification.

- Convenience and Flexibility:

The absence of hidden charges enhances the convenience and flexibility of checking BVN on the GTBANK app. Users can spontaneously check their BVN without the need for complex calculations or budgeting. This convenience empowers users to manage their finances effectively and make informed decisions without the constraints of additional costs.

- Competitive Advantage:

By offering a service with no hidden charges, the GTBANK app gains a competitive advantage in the market. Users are more likely to choose the GTBANK app over other platforms that may impose hidden fees or charges. This competitive advantage contributes to the app's popularity and user base.

In summary, the absence of hidden charges in checking BVN on the GTBANK app is a significant factor that enhances transparency, cost-effectiveness, convenience, and the app's competitive standing. It aligns with the user's desire for clarity, affordability, and ease of use when managing their financial information.

24/7 Availability

The 24/7 availability of the GTBANK app is a crucial aspect of "how to check BVN on GTBANK app" as it provides unparalleled convenience and accessibility to users.

In today's fast-paced world, the ability to access financial information and services around the clock is essential. The GTBANK app recognizes this need and offers its services 24/7, empowering users to check their BVN whenever it is convenient for them. This flexibility is particularly beneficial in situations where immediate access to BVN is required, such as during urgent financial transactions or when responding to time-sensitive requests.

Furthermore, the 24/7 availability of the GTBANK app eliminates the constraints of traditional banking hours. Users are no longer restricted to checking their BVN during specific time slots or waiting for bank branches to open. Instead, they can access their BVN at any time of the day or night, regardless of their location. This convenience enhances the overall user experience and empowers individuals to manage their finances effectively, even outside of regular business hours.

In summary, the 24/7 availability of the GTBANK app is a key component of "how to check BVN on GTBANK app" as it provides users with unparalleled convenience, accessibility, and flexibility in managing their financial information.

FAQs on How to Check BVN on GTBANK App

This section provides answers to frequently asked questions about checking BVN on the GTBANK app. These questions address common concerns and misconceptions, offering clear and informative responses.

Question 1: How do I check my BVN on the GTBANK app?

Answer: Checking your BVN on the GTBANK app is simple and convenient. Simply log in to the app using your account credentials, navigate to the "Settings" menu, select "Personal Information," and then click on "BVN." Your BVN will be displayed on the screen.

Question 2: Are there any charges associated with checking my BVN on the GTBANK app?

Answer: No, there are no hidden charges or fees associated with checking your BVN on the GTBANK app. You can check your BVN as often as needed without incurring any additional costs.

Question 3: Can I check my BVN on the GTBANK app if I don't have an internet connection?

Answer: Yes, you can check your BVN on the GTBANK app even if you don't have an internet connection. Simply dial 5650# on your mobile phone, and your BVN will be displayed on the screen.

Question 4: Is it safe to check my BVN on the GTBANK app?

Answer: Yes, it is safe to check your BVN on the GTBANK app. The app employs robust security measures to protect your personal and financial information. Your BVN is encrypted and stored securely, and all transactions are protected by multiple layers of security.

Question 5: What should I do if I have forgotten my BVN?

Answer: If you have forgotten your BVN, you can retrieve it by dialing 5650# on your mobile phone. Your BVN will be sent to the phone number linked to your bank account.

Question 6: Can I link my BVN to multiple bank accounts?

Answer: Yes, you can link your BVN to multiple bank accounts. To do this, simply visit any branch of your bank and provide your BVN and the account numbers you wish to link.

Summary: Checking your BVN on the GTBANK app is a simple, convenient, and secure process. There are no hidden charges associated with checking your BVN, and you can do so as often as needed. If you don't have an internet connection, you can still check your BVN by dialing 5650# on your mobile phone.

For more information on checking your BVN on the GTBANK app, please visit the bank's website or contact customer service.

Conclusion

Checking your BVN on the GTBANK app is a simple, convenient, and secure process. By following the steps outlined in this article, you can easily retrieve your BVN anytime, anywhere. The GTBANK app offers a user-friendly interface, real-time access, and multiple layers of security to ensure a seamless and protected experience.

Remember, your BVN is a crucial piece of information for financial transactions in Nigeria. By regularly checking your BVN on the GTBANK app, you can ensure that your information is up to date and secure.